ICHRA benefits administration: How to stand out in growing ICHRA plan segment

ICHRA plans are growing fast and savvy third party administrators know they need to adapt to keep up. ICHRA administration is not unlike group HRA plan administration, but may be an opportunity for TPAs to offer consulting services for employers looking to optimize their plan offerings.

Keep reading to find out what you need to know in the second article of our “TPA Trends” series.

When did ICHRAs become popular?

In recent years, the use of Individual Coverage Health Reimbursement Arrangements (ICHRAs) has grown in popularity as a way for employers to provide healthcare benefits to their employees. This category of benefits offers an opportunity for TPAs to capture marketshare from employers who may be new to an ICHRA plan and need administrative support. Read on for an overview of ICHRAs and our analysis of what TPAs can do to capitalize on this market to win more marketshare.

What is an ICHRA?

An ICHRA is a type of health benefit plan that allows employers to offer a set amount of money to their employees, who can then use that money to purchase individual health insurance plans that meet their specific healthcare needs. ICHRAs are a valuable tool for employers who want to provide their employees with healthcare benefits but are unable or unwilling to offer traditional group health insurance plans.

What’s the best scenario for an ICHRA?

While ICHRAs are available to any employer in the United States, they may be more popular in certain regions, industries, and company size. ICHRAs have been available since 2020, and as such, their use is still relatively new. However, we can look at data and reports to see where they are being used more frequently. According to a 2021 survey conducted by the National Association of Health Underwriters, now National Assoication of Benefits and Insurance Professionals, ICHRAs are most popular among small employers with 50 or fewer employees. This is likely because these employers may have less bargaining power with insurance providers and may not have the resources to manage a traditional group health insurance plan.

ICHRA for small businesses? You bet.

This is especially true for small businesses, which may not have the resources to manage a traditional group health insurance plan or the bargaining power to negotiate competitive rates with insurance providers. You can read more about other savings for small businesses in our article “6 Ways to Lower Employee Benefits Costs for Your Business” here.

What types of companies can use an ICHRA?

ICHRAs are also popular in certain industries, such as technology and startups, where employers may be more likely to offer non-traditional benefits to their employees. In these industries, ICHRAs may be seen as a way to provide competitive healthcare benefits to employees, without the administrative and cost burdens of traditional group health insurance plans.

Where are ICHRAs popular?

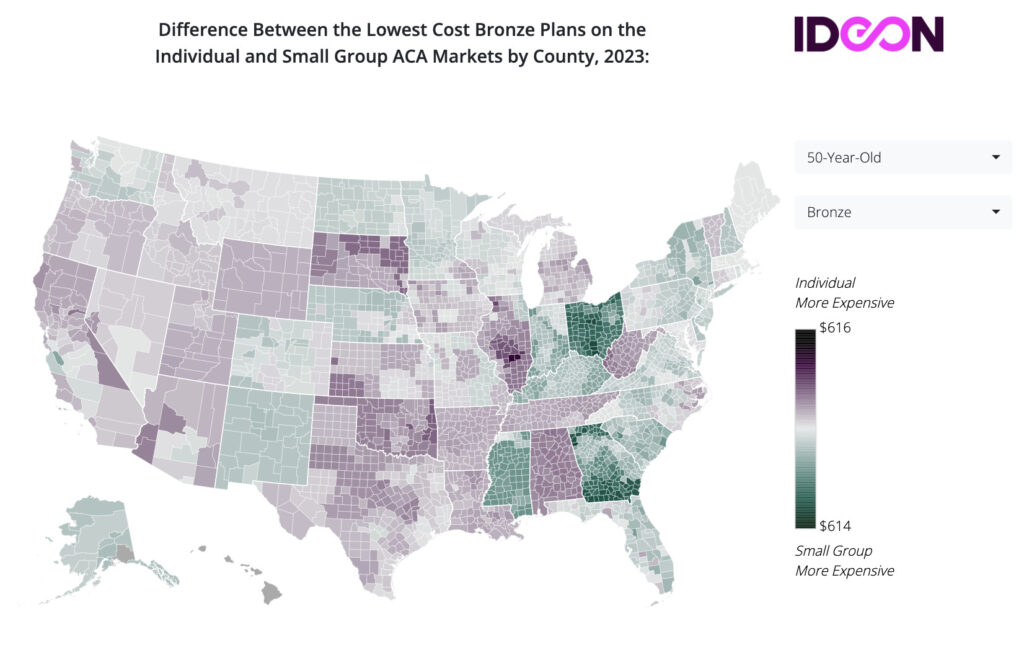

ICHRAs are available to any employer in the United States, but their popularity may vary by state or region. According to a 2021 report from the Employee Benefits Research Institute, ICHRAs were most commonly offered in the Northeast and West regions of the United States. This may be due in part to the higher cost of living and healthcare in these regions, which can make ICHRAs a more cost-effective option for employers. Ideon annually releases an ICHRA map that highlights down to the county level where an individual plan is more cost-effective for the same coverage than a group plan. See the inset image for a snapshot of this map.

What is needed for ICHRA Administration?

Benefit third party administrators (TPAs) play a critical role in administering ICHRAs by providing a range of services tailored to the needs of employers offering these plans. TPAs can help employers with plan design, compliance, and cost management, as well as offering tools like automatic Claims Harvesting and consolidated Employer Invoicing to ensure that the plan is run efficiently and effectively. By partnering with a TPA, employers can provide high-quality healthcare benefits to their employees, while also managing costs and remaining compliant with regulations.

How can TPAs win market more marketshare for ICHRA administration?

Third party administrators (TPAs) of employee benefit plans can capitalize on this trend by offering services tailored to the needs of employers that offer ICHRAs. By providing support and expertise in managing ICHRAs, TPAs can help employers navigate the complexities of this type of health benefit plan, making it easier for them to offer competitive benefits to their employees. If you already administer CDH, you’re well on the way to capturing more ICHRA clients.

One way that TPAs can differentiate themselves in the market is by offering a range of services that go beyond traditional claims processing and administrative support.

Detailed invoices and reporting are important

Employers who offer ICHRAs need really robust billing because there are a lot of factors to manage with this type of plan. With ICHRAs, employers must provide their employees with a monthly allowance that can be used to purchase health insurance plans. This can create administrative challenges, especially when employees choose plans with different premiums or other cost-sharing arrangements.

By offering detailed consolidated Employer Invoicing, TPAs can simplify the billing process for employers, providing a single invoice that breaks down the costs associated with each employee. This can help employers better understand their benefits spending and make informed decisions about how to allocate their resources.

Becoming a consultative partner

TPAs who take a highly consultative approach can use the data gathered from Claims Harvesting to help consult with the broker on opportunities to improve the plan TPAs can help employers gain a better understanding of the healthcare services being used by employees, and identify areas where cost savings can be achieved. For example, they may identify areas where employees are overusing certain healthcare services or where there are opportunities to negotiate lower prices with providers.

By partnering with a TPA that offers specialized services tailored to the needs of ICHRAs, employers can ensure that they are providing the best possible benefits to their employees, while also keeping costs under control. With Claims Harvesting and Employer Invoicing, TPAs can provide flexible and responsive support to employers with complex healthcare plans, making it easier for them to focus on what matters most – running their business.

How should TPAs position their services around ICHRA plan administration?

How to market ICHRA administration

TPAs might use language like the following to talk about their services for ICHRA accounts.

“Are you struggling to provide competitive healthcare benefits to your employees? With our support, you can offer the benefits your employees want, without the administrative headaches that come with traditional group health insurance plans. Our team of experts will help you navigate the complexities of ICHRAs, from setting up your plan to managing claims and billing. With our claims harvesting and detailed consolidated employer invoicing services, you can be confident that you’re getting the best value for your healthcare dollars. Contact us today to learn more about how we can help you offer competitive benefits to your employees, while keeping costs under control.”

Sample RFP language for ICHRA administration

TPAs might use language like the following in an RFP cover letter about their ICHRA administration services.

Dear [Company Name],

We at [TPA Name] are thrilled to offer our expertise in administering Individual Coverage Health Reimbursement Arrangements (ICHRAs) for your employees. As a trusted third-party administrator, we are dedicated to providing top-notch service and support to ensure that your ICHRA plan is managed effectively and efficiently.

Our team of experienced professionals is well-versed in the latest rules and regulations surrounding ICHRAs, and we are committed to staying up-to-date on any changes that may impact your plan. We offer a range of services, including plan design, compliance management, and cost management, all designed to help you get the most out of your ICHRA plan.

In addition, our innovative Claims Harvesting technology can help streamline the claims process, making it easier for your employees to get reimbursed for eligible expenses. We also offer consolidated invoicing, so you can easily manage your budget and keep track of your plan expenses.

At [TPA Name], we understand that every company is unique, which is why we offer flexible solutions that can be tailored to meet your specific needs. Whether you need assistance with plan design or ongoing support, we are here to help.

Thank you for considering [TPA Name] for your ICHRA administration needs. We are confident that we can provide the expertise and support necessary to help your employees get the healthcare coverage they need while managing costs and ensuring compliance.

Please don’t hesitate to reach out to us with any questions or to schedule a consultation.

Sincerely,

[Your Name]

[TPA Name]

Concluding thoughts

Even if you have yet to have an ICHRA plan on your books, if you’re set up with Employer Invoicing and Claims Harvesting, administering an ICHRA is simple and a logical extension of any CDH administration you’re already doing. The complexity that comes with these plans is very manageable, given the amount of integration power these two solutions hold.

If you administer ICHRAs and are not yet using these solutions, we’d love to show you how we can take your ICHRA administration business to the next level by scheduling a demo.